Compare rates and features to make the right choice

Source: Comprehensive Data Insights as of January 2025

Browse our loan options and select the one that best fits your needs

Gather required documents including valid ID, proof of income, and completed forms

Visit our office or submit online with all required documents and forms

Get fast approval with our streamlined process and minimal requirements

Get your approved loan amount disbursed quickly to your account

Convenient loan accessed through your ATM, giving you cash when you need it. Perfect for members with regular payroll deposits.

Key Benefits You’ll Love:

✅ ATM Convenience – Uses your ATM card as collateral for easy access

✅ Longer Repayment – Enjoy up to 5 years to pay

✅ Renewal Ready – Eligible again after just 3 months of payments

✅ Flexible Options – Choose between co-maker or salary deduction

📌 Click below to check requirements & apply now!

Capital support for starting or expanding your business. Flexible terms to help your enterprise grow.

Why Entrepreneurs Choose Us:

✅ Serious Funding – ₱600,000 for substantial business growth

✅ Growth-Aligned Terms – 5 years to repay as your business flourishes

✅ Early Renewal – Eligible after paying 50% (with 3-month clean record)

✅ Flexible Security – Options with or without co-makers

📌 Click below to check requirements & apply now!

Financing for laptops, desktops, or gadgets. Stay connected and productive for work, school, or personal use.

Why This Tech Loan Works for You:

✅ Full-Spec Budget – Covers high-end laptops or complete desktop setups

✅ Extended 3-Year Term – Smaller monthly payments

✅ New Purchase Protection – Valid for computers bought within last 3 months

✅ Work-From-Home Ready – Finance productivity tools effortlessly

📌 Click below to check requirements & apply now!

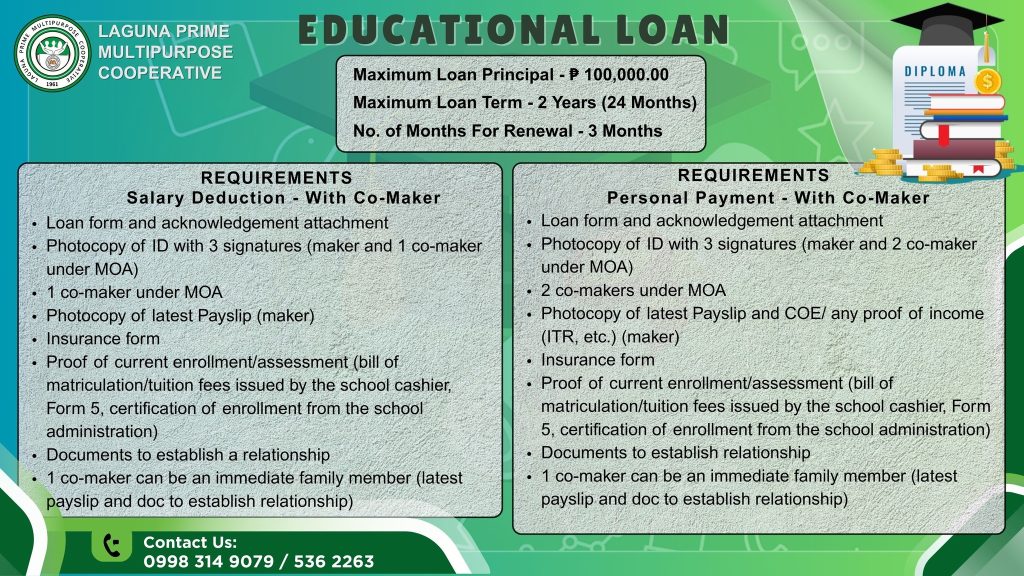

Support for tuition fees, school expenses, and learning needs. Invest in your or your family’s future.

Why This School Loan Stands Out:

✅ Complete Coverage – ₱100,000 for tuition, books, and school fees

✅ Study-Friendly Terms – 2 years to repay after enrollment

✅ Early Renewal Option – Eligible after paying just 30%

✅ Academic Proof Only – No collateral required, just enrollment documents

📌 Click below to check requirements & apply now!

Quick financial assistance for medical and hospital bills. Focus on recovery while we handle the cost.

Why This Medical Loan Helps:

✅ Fast Medical Funding – Quick access to ₱50,000 for emergencies

✅ Health-First Terms – 3 years to repay while you recover

✅ Early Renewal – Eligible after paying just 30% of the loan

✅ Flexible Options – Choose salary deduction or co-maker plans

📌 Click below to check requirements & apply now!

Financing to build, purchase, or improve your home. Make your dream house a reality.

Why This is the Best Home Financing Solution:

✅ Massive Funding Capacity – Borrow up to ₱4M for major projects

✅ Long-Term Comfort – Repay over 15 years with manageable installments

✅ Dual Purpose – Available for both new construction and renovation projects

✅ Flexible Payment – Choose between salary deduction or personal payment options

📌 Click below to check requirements & apply now!

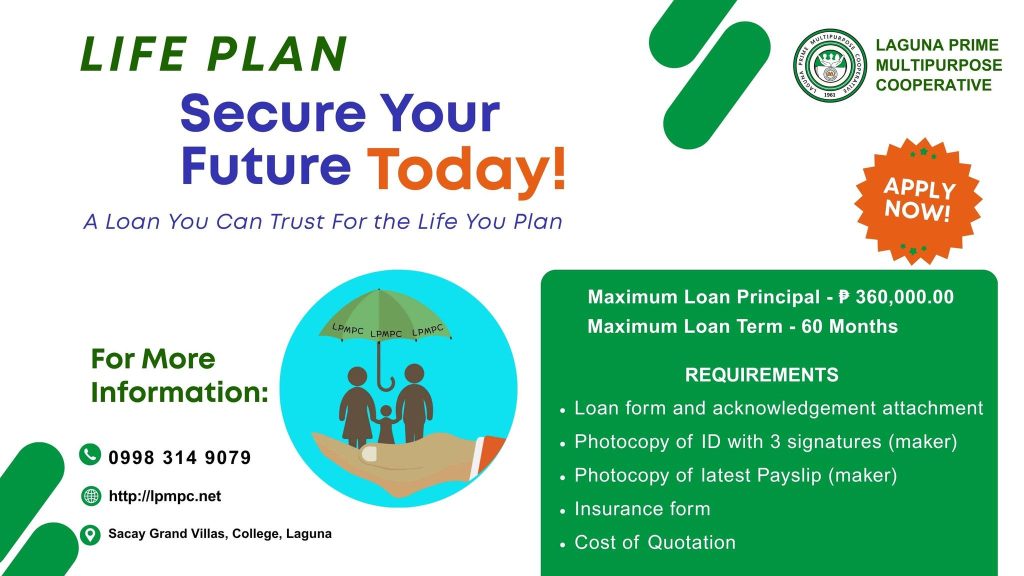

A loan designed to cover life plan or pre-need arrangements. Helps ensure long-term family security.

Why This Loan Brings Comfort:

✅ Complete Coverage – Up to ₱360,000 for memorial services

✅ Long-Term Planning – 5 years to prepare without financial strain

✅ Simplified Process – Minimal requirements for quick approval

✅ Dignified Preparation – Secure arrangements in advance

📌 Click below to check requirements & apply now!

Affordable financing to secure memorial lots in advance. Plan ahead for peace of mind.

Key Benefits:

✅ Dignified Preparation – Finance a resting place in advance

✅ Simple Process – Minimal documentation required

✅ Flexible Options – Choose with or without co-maker

✅ Quick Approval – Get confirmation faster than traditional options

📌 Click below to check requirements & apply now!

Small-value loan for daily expenses or sudden needs. Light and manageable repayment terms.

Why This is Your Go-To Small Loan:

✅ Ultra-Fast Processing – Get cash when you need it most

✅ Minimal Requirements – Just your ID and completed form

✅ No Co-Maker Hassle – Simple salary deduction option

✅ Perfect for Emergencies – Covers those unexpected bills

📌 Click below to check requirements & apply now!

Loan for buying land or property investments. Secure your future with real estate ownership.

Why Choose Our Property Financing?

✅ Substantial Funding – Up to ₱4M for major real estate projects

✅ Long-Term Repayment – 15 years to comfortably pay off your investment

✅ Dual Purpose – Perfect for both new construction and property renovations

✅ Secure Process – Legal safeguards including title verification and tax clearance

📌 Click below to check requirements & apply now!

A restructured option to make loan payments easier and more affordable. Designed to help members manage existing obligations.

Why This Loan Helps You Recover:

✅ Financial Reset – Restructure existing obligations for better manageability

✅ Flexible Terms – Choose between salary deduction or personal payment options

✅ Co-Maker Flexibility – Options available with or without co-makers

✅ Personalized Solutions – Letter of request allows customized arrangements

📌 Click below to check requirements & apply now!

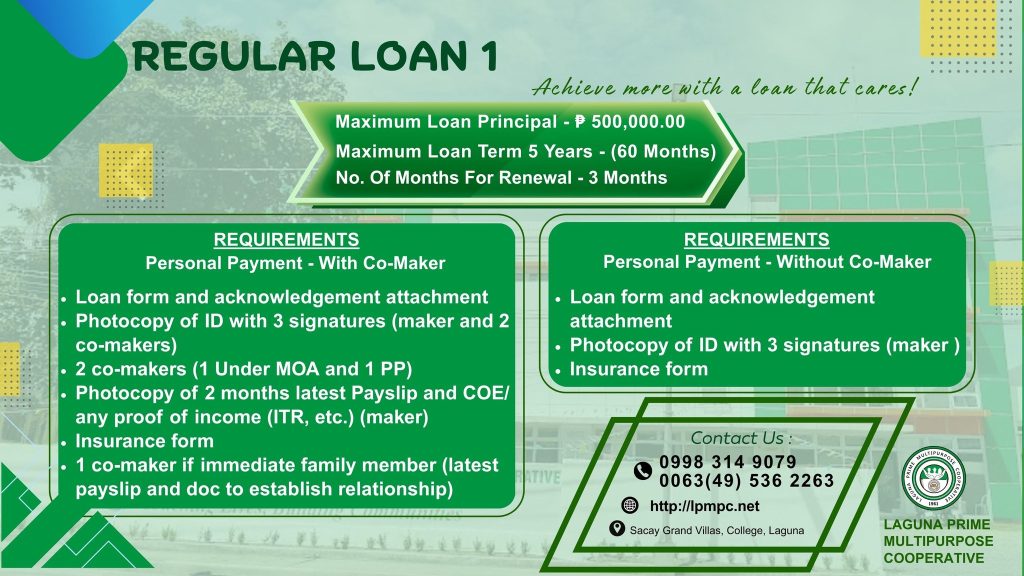

A higher-value multipurpose loan with longer repayment terms. Best for larger expenses or investments.

Key Advantages:

✅ Substantial Amount – ₱500,000 for major expenses

✅ Extended Term – 5 years for comfortable repayments

✅ Quick Renewal – Eligible after just 3 months of payments

✅ Flexible Approval – Options available with or without co-makers

📌 Click below to check requirements & apply now!

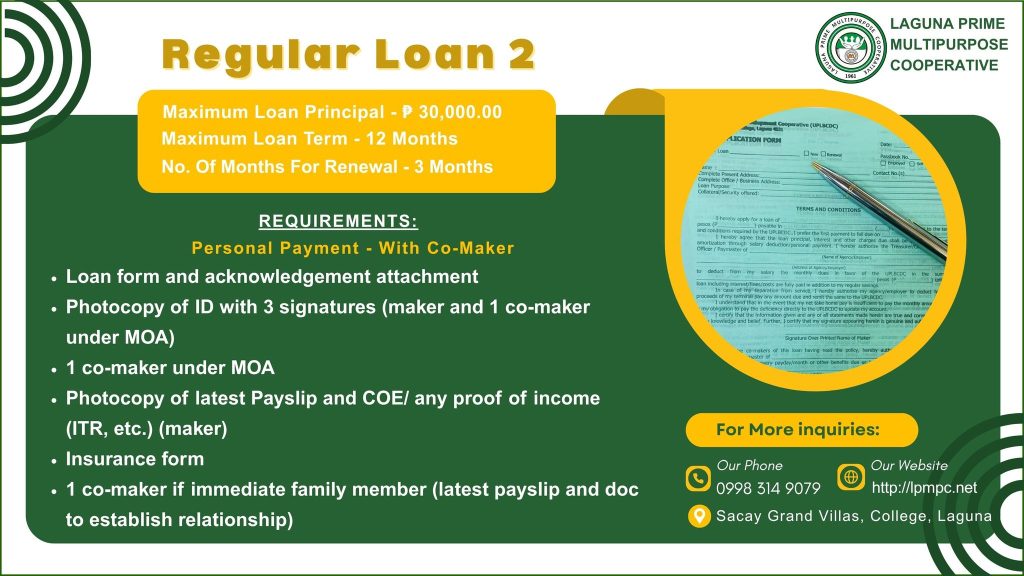

A general-purpose loan for personal or household needs. Offers flexible terms and manageable payments.

Why Choose This Loan?

✅ Instant Access – ₱30,000 disbursed fast

✅ Short-Term Flexibility – 12 months to repay

✅ Easy Renewal – Qualify again after 3 months of payments

✅ Minimal Requirements – Basic documents only

📌 Click below to check requirements & apply now!

Quick access to funds against your salary for immediate financial needs. Ideal for short-term expenses and emergencies.

Why Choose Our Salary Loan?

✅ Borrow up to ₱600,000

✅ Repay over 6 years (72 months)

✅ Renew after just 3 months of on-time payments

✅ Easy requirements: Just submit your ID, payslip, and completed forms

📌 Click below to check requirements & apply now!

Flexible loan for urgent or small-scale financial requirements. Easy to apply and faster to pay back.

Key Benefits:

✅ Mid-Range Funding – ₱50,000 for larger immediate needs

✅ Manageable Timeline – 24 months to repay comfortably

✅ Fast Renewal – Eligible after just 3 months of payments

✅ Flexible Approval – Options with or without co-maker

📌 Click below to check requirements & apply now!

Higher-value financing for cars or larger vehicles. Flexible terms to match your budget and lifestyle.

Why Choose Our Auto Financing?

✅ Big Purchasing Power – Cover vehicles up to ₱1.8M

✅ Extended 5-Year Term – Lower monthly payments

✅ Flexible Options – Salary deduction or personal payment plans

✅ Complete Protection – Includes insurance and legal safeguards

📌 Click below to check requirements & apply now!

Financing for motorcycles or entry-level vehicles. Easy approval and affordable monthly payments.

Why This Loan Accelerates Your Plans:

✅ Right-Sized Financing – ₱300,000 for practical vehicle needs

✅ Simpler Process – Fewer documents than larger auto loans

✅ Co-Maker Flexibility – Option available if needed

✅ Complete Protection – Includes insurance and legal verification

📌 Click below to check requirements & apply now!

Calculate your loan details and monthly payments

For further assistance, contact the Loans Department at loans@lpmpc.net or contact 0998 314 9079 or visit the main office during business hours.

Loan eligibility requirements often include:

Some loan types, such as emergency loans or calamity loans and petty cash loan, may be available to new members immediately, depending on the cooperative’s policies.

You may apply for regular loans after fulfilling all membership and financial requirements, as outlined in the cooperative’s guidelines.

Typically, new members need to meet certain requirements before being eligible to apply for a loan. This may include maintaining an account for a specified period or completing a minimum share capital contribution.

Housing, Real Estate Loan and Regular Loan

Vehicle Loan I

ATM Loan

MOA or Members under Salary Deduction/ Memorandum of Agreement

PP or Personal Payment

Each member can sign for co-makership after 3 months of membership for up to 3 members. Member with no default or with less than 3 months of arrears can sign for co-makership. Members with “Liability as co-maker” are not allowed to sign for co-makership unless the liability is settled. 1 co-maker may be required if the person/ co-maker is an immediate family of the maker.

Member acknowledgement of loan terms and conditions

Authorization for ATM-based salary deduction

Online form for submitting insurance applications and coverage requests.

Member application for loan request and processing

Short-term loan request for immediate financial needs

Sworn statement for verification or clarification of details

Authorization for representative to act on member’s behalf

Our loan officers are ready to assist you with completing your application forms and answering any questions you may have.